Table of Contents

Tax Setup

Item Based Tax

Use item based tax calculation if product tax rates varies by product type. For example in some countries Alcholic Drinks tax rate is different than food. In this case we'll create Tax templates for Alcholic drinks and food.

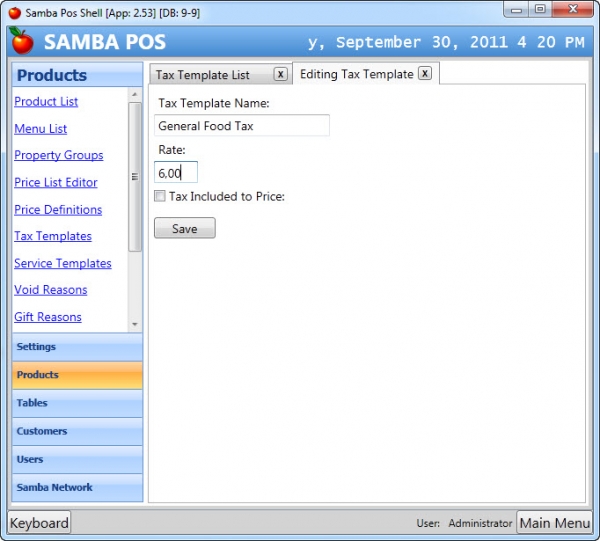

You can configure tax name, tax rate and if tax amount is included in price. Tax name will be displayed in printouts. For this reason name it as it should display on bills or invoices.

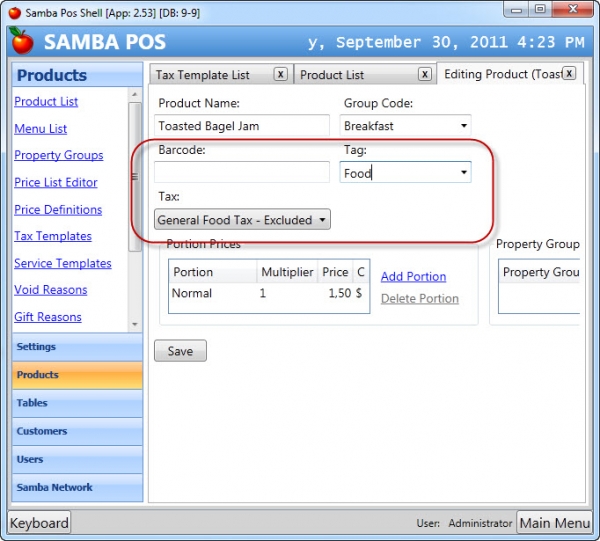

After creating templates we'll configure product tax rates. As seen on the screenshot I filled Tag setting too. While printing invoices we can group items by their tag and print line amount sum. We can configure it from Print Jobs.

Ticket Based Tax

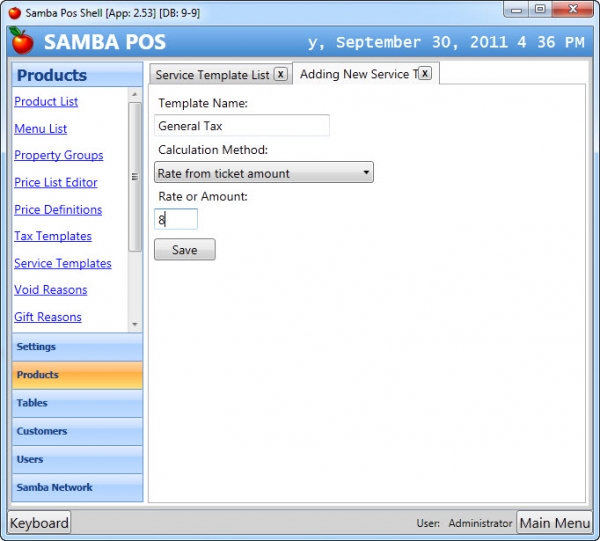

If you want to add a fixed rate Tax amount to a ticket you can use Service Templates. Normally we use service templates to increase ticket amount by rate or fixed amount so it can be used for calculating taxes too. We can name it as we wish.

To add a fixed rate Tax amount to a ticket navigate to “Products > Service Templates”.

Some taxes uses different calculation methods. Change calculation setting for choosing a different rate calculation method or a fixed amout.

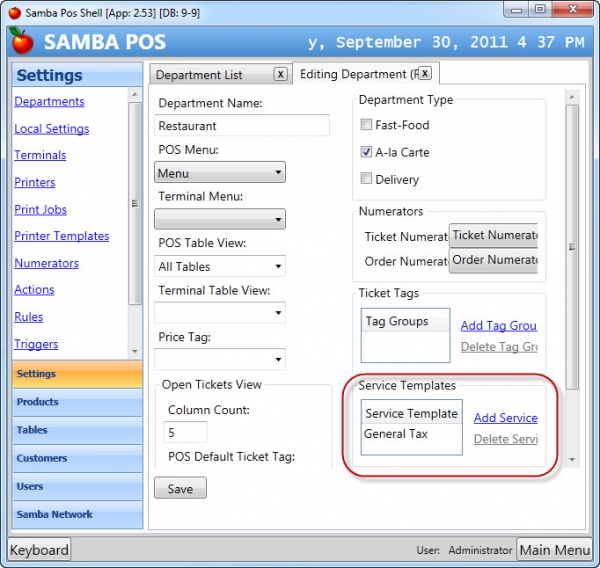

After creating the service template we have to assign it to a department. Some tax types does not apply on all departments. For example you might not use table type taxes on delivery department. In some countries food served on restaurant and on bar has different tax rates.

We assinged General Tax to Restaurant department so all tickets we create from restaurant department will include General Tax.

If you use multiple tax rates you'll see calculation total under ticket display but it is possible to print tax amount details under printouts.